The Essential Role of a CFO in Addressing Key Challenges for NDIS Providers

Thanks to our CFO On-Call Rangan Vaithi for sharing this helpful article about “Addressing Key Challenges for NDIS...

Read Story

Managing your business’s cash flow can be a complex and headache-inducing task. As a business owner, you would naturally prefer to put your time and energy into the things that you know you do best — running your business and bringing in money. Our experts at CFO On-Call can help demystify the process of cash flow management and bring greater clarity and understanding to where your cash is going.

There are many factors affecting cash flow that, if understood, can make it much easier to manage your money over the long term. The keys to a net positive cash flow are understanding what impacts the movement of money — from cash flow forecasting to planning a strategy based on the plan.

If you want to be proactive about your cash flow management and want to eliminate the stress and headaches of poorly organised documentation, we are here to help. Our team of experts can help your business by offering the following cash flow management services:

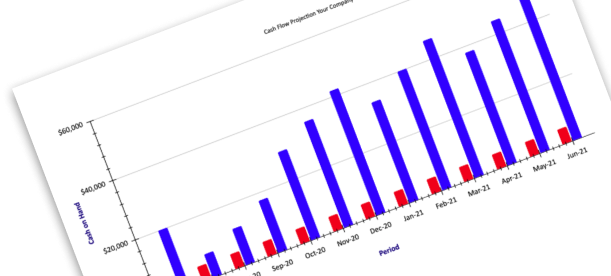

Cash flow forecasting, along with cash flow projection, plays a significant role in the process of cash flow management. Because of this, our outsourced CFOs are ready to assist you and your business in all areas of managing your current and future cash positions. Whether you’re looking for a one-off service to help with cash flow management or would like to hire an outsourced CFO for a longer-term engagement to help with your business’ financials, a virtual CFO from CFO On-Call will bring infinite value to your business.

Providing cash flow management advisory services to remote areas is no problem for our virtual CFOs Australia-wide. Whether your business is in Mackay, Melbourne, Brisbane, Sydney, Perth, Newcastle or any regional area, we can provide an outsourced CFO cash flow management service to meet your needs.

Our highly experienced virtual CFOs have many years of experience working with different industries in locations across Australia and New Zealand. Interested in learning more about how our cash flow management services can help you maintain a sustainable and profitable business? Contact us to arrange a brief chat today!

Wondering how exactly outsourced cash flow management services can become an essential branch in your business?

A good Virtual CFO is right-hand to the boss but on the numbers side. Someone who has worked for bigger corporations, sometimes listed companies. Someone who has been head of finance, skilled in business numbers and knows how the numbers affect the decision-making process of department managers and the CEO.

Do you need greater certainty in the financial outcome? SMEs who could only dream of hiring a CFO are now able to take advantage of a CFO On Call.

Contact Us

Simple, accurate and timely reports to guide you to the right decisions.

If your overall profit is made up of too many losers and not enough profitable lines you could be missing out.

‘Non financial’ information is what drives profit and Cash Flow results.

Analyse how things work and find ways to save time and money.

Our virtual CFOs have spent years developing cash flow management strategies that drive profit. Most importantly, regular clients make a *51% improvement in profit.

A Virtual CFO for hire is a corporate gun; an elite financial freelancer available 24/7 to meet any business’s needs as they arise. These virtual cash flow management CFOs engage with clients in the most effective way, accessing accounts and spreadsheets via cloud-based programs and dispensing their advice over video streaming services like Skype or WhatsApp, as well as in person. In this way, duplication is cut, along with transport costs and time spent travelling to and from face-to-face meetings.

Read Case Studies

Virtual CFO’s Australia Wide. Tell us about your financial challenges. We can talk by phone, online or in person.

Call 1300 36 24 36Cash Flow means the flow of cash in and out of a business. It takes into account the timing of cash coming into the business from various sources e.g. sales, loans, tax refunds, interest etc. It also accounts for cash going out of the business, e.g. expenses, taxes, dividends, asset purchases, etc. The timing of cash movements is different to that of profit and loss.

Profit and Loss Reporting involves measuring costs against sales when they are made, not when you get paid for them, if you offer terms to your customers. This is where lots of businesses get into trouble. They are making plenty of sales but aren’t getting paid quickly enough. On top of that, they are paying suppliers, staff, landlords, etc. and then end up with Cash Flow squeeze.

Our virtual CFOs provide tailored cash flow advisory services to help get your business back on its feet.

The best way to manage daily cash flow is to run a daily Cash Flow forecast. Use this report on a daily basis, as it can identify financial areas that demand your attention. For instance, when a business is in severe Cash Flow stress, this is a very useful tool. Cash flow management enables you to manage the situation on a daily basis. You can see when you are able to pay people based on the daily balance. It shows where you need to speed up funds coming into the business e.g. chase customers for payment or inject funds from shareholders or outside lenders/investors.

The best way to improve Cash Flow is to take your cash flow management more seriously and clearly understand what impacts it the most. The key ‘levers’ of Cash Flow are Sales, Costs & Overheads, Pricing, Customer Payments, Suppliers Payments, Inventory, Jobs in progress, taxes and interest.

You then need to put in place a process for proactively managing these ‘levers’. Each one needs a project of its own and someone in charge of it to ensure it happens and they are accountable. Your Cash Flow Forecast is your ‘bible’ for improving Cash Flow. It’s the proof in black and white on how things are progressing.

Our cash flow management CFOs know how cash moves through a business and how to speed it up or slow it down to suit the situation. They are totally dedicated to a proactive focus on managing cash in a business, to ensure it doesn’t run out and there is enough to handle growth without the headaches.

CFOs are great at facilitating discussions with suppliers, lenders, investors, landlords etc. to negotiate the best possible terms for the business, to maximise Cash Flow effectiveness. They are also very adept at seeing Cash Flow improvement opportunities quickly. Due to their decades of experience, they know what to look for to quickly free up cash in any business.

We often find money sitting in the wrong place i.e. not in business bank accounts. There are quite a few places it can be. We’re happy to discuss them with you and help you to move the funds more quickly into your business bank account, so that you can more easily pay all your expenses and grow your business more efficiently through our cash flow management advisory services.

Cash Flow management is the most important aspect of the financial health of a business. Running out of cash is probably the single biggest contributor to business failure. Many businesses can be profitable, but if they don’t focus on the issues affecting Cash Flow, they are headed for constant headaches and business failure. Not being able to pay your bills on time is the biggest problem for many business owners.

It creates anxiety, poor staff morale and limits the ability of the business to grow and prosper. Our cash flow management services make these issues a thing of the past. We equip you with the right skills you’ll put into practice for years to come.

The biggest benefit of Cash Flow management is that it provides confidence for business owners and management that the business is sustainable. Many people believe that if they just sell enough… Cash Flow will take care of itself. This is a dangerous myth! Cash is required to fund sales i.e. to pay for products to sell before you’ve been paid by customers and to pay for expenses such as wages, rents etc.

If it’s the case that you need cash to fund sales… the more sales you make, the more cash you need. If this isn’t taken into consideration when a business begins to grow, Cash Flow squeeze is the result. Growth can actually be the Cash Flow downfall of a profitable business!

Your business will benefit from hiring a virtual CFO for cash flow management, no matter what stage it’s at. Cash flow issues can have serious implications on your business’ capacity for growth.

Whether you’re just starting or are an established business owner looking to branch out and increase growth, it is vital to have sufficient cash flow management strategies in place to deal with the costs of running your business. A virtual CFO will assist with planning and forecasting to ensure your business is in the best possible position to manage incoming and outgoing funds.

At CFO On-Call, we work with a range of industries in Sydney, Melbourne, and other areas within Australia and New Zealand to provide cash flow management services. All businesses require effective cash flow management in order to operate effectively, and we specialise in helping small and medium firms get their strategy on track.

When it comes to business cash flow management, we work with numerous industries, including trades, printing and manufacturing, building and construction, mechanical engineering, high tech, freight transport and logistics, wholesale and distribution, and professional services. We tailor our cash flow management strategies and focus to ensure that the business we’re working with receives the most efficient cash flow strategy for your specific needs.

Even well-performing businesses benefit from having a CFO look into their cash flow management. A profitable business can still be headed for failure (or constant headaches) if cash flow issues are not adequately addressed — being unable to pay bills on time is a major problem for many business owners.

Cash flow management CFOs understand cash movement in business and can either slow it down or speed it up to suit the situation at hand. This frees you as the business owner to manage all of the other important aspects of your business!

Although they are not the same thing, forecasting plays a key component in effective cash flow management. Cash flow forecasting allows you to plan your cash flow and plot what will happen to it under a particular set of circumstances. A virtual CFO can help you in all cash flow management and forecasting areas to ensure your business is ready for anything.

*Average profit improvement for CFO On Call clients over a two-year period (pre-COVID).

Thanks to our CFO On-Call Rangan Vaithi for sharing this helpful article about “Addressing Key Challenges for NDIS...

Read StoryThanks to our CFO On-Call, Rangan Vaithi, for sharing this helpful article about Creating a Technology Roadmap. ...

Read StoryGet the financial information you need to shed light on your financial blind spots, improve your efficiency, and bolster your cashflow. Click below to order your book.

Order My Copy