Navigating Success: Profit Maximization Strategies for SME Businesses

In the dynamic landscape of Small and Medium-sized Enterprises (SMEs), the pursuit of profit maximization is a constant...

Read Story

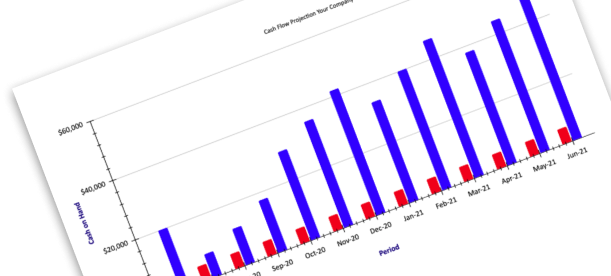

Cash flow forecasting can be a bit of a mystery to some people. We like to think of it as plotting out in ‘black and white’ terms. Cash flow forecasting is the process of estimating the future movement of your business’s revenue and costs/expenses. This information can be utilised to decide how to use the ‘cash’ available. Tackling these problems alone can be daunting and often a waste of time. That’s why it’s essential to have a supportive service that can help you navigate the more complex aspects of business cash flow management.

Creating plans for cash flow projection

CFO On-Call will give you access to industry-leading financial professionals who can help create cash flow statements, so you can have a clear idea of your company’s financial position. By managing your working capital and improving your systems for business operations and individual project oversight, we can work with you to create an effective cash flow projection.

A cash flow projection sets out the ‘peaks and troughs’ in the future of your cash position. Creating an in-depth cash flow projection will prepare your business for financial fluctuations.

Meet your financial goals remotely

Cash flow liquidity is a measure of a company’s ability to meet its short-term financial obligations. It is calculated by dividing a company’s current assets by its current liabilities. This is where we come in. We will work with you to effectively monitor and manage cash flow projection and liquidity. Our virtual CFOs always aim for a higher ratio, which indicates that your company has more cash available to meet its short-term obligations.

CFO On-Call is here to help you run a smoother operation, so we will work with you to find the most convenient solution for effective collaboration. Remote areas are no problem for our Virtual CFOs Australia-wide. No matter where you’re based, we can deliver our services for the betterment of your company. Whether your business is in Mackay, Melbourne, Brisbane, Sydney, Perth, Newcastle or any regional area, we can provide an outsourced CFO service to meet your needs.

CFO On-Call — reliable virtual financial help

Our virtual CFOs can be on-call at your convenience, working with you to manage expectations and provide helpful knowledge and expertise. If you need advice, guidance or tailored help regarding your company’s cash flow projection and liquidity, CFO On-Call is the service for you. Our CFOs have years of experience in cash flow forecasting, so you can rest assured that you will be in good hands. Contact us today to learn more about how you can improve so your business has the proper systems to encourage growth.

Decide on the periods of your forecast i.e. daily, weekly, monthly etc.

Do you need greater certainty in the financial outcome? SMEs who could only dream of hiring a CFO are now able to take advantage of a CFO On Call.

Contact Us

Simple, accurate and timely reports to guide you to the right decisions.

If your overall profit is made up of too many losers and not enough profitable lines you could be missing out.

‘Non financial’ information is what drives profit and Cash Flow results.

Analyse how things work and find ways to save time and money.

A Part Time CFO is a corporate gun; an elite financial freelancer available 24/7 to meet any business’s needs as they arise. These CFOs engage with clients in the most effective way, accessing accounts and spreadsheets via cloud-based programs and dispensing their advice over video streaming services like Skype or WhatsApp, as well as in person. In this way, duplication is cut, along with transport costs and time spent travelling to and from face-to-face meetings.

Read Case Studies

Virtual CFO’s Australia Wide. Tell us about your financial challenges. We can talk by phone, online or in person.

Call 1300 36 24 36Sometimes in business, the movement of cash can get quite confusing. The bank balance may look fine, but you’re never really sure how much of it is yours. There are taxes to pay, outstanding supplier invoices and monthly charges. A cash flow forecast plots it all out in black and white to see exactly what your cash position will be at the end of each month, week or day.

Cash flow forecasting and projections allow businesses to better manage their finances by predicting future cash flow needs. This allows for better budgeting and planning, leading to increased profitability and decreased financial risk. Additionally, cash flow forecasting can help identify potential problems early on, so corrective actions can be taken before they become too difficult or costly to address.

It eliminates the guesswork so you can feel confident about your cash position. Once you’ve plotted it all out, it puts you in a position to keep your organisation running confidently. Having a professional CFO cultivate and manage these systems for you means that you will have a clear plan for the future success of your business. The biggest benefits are minimising risk and maximising potential growth.

Partnering with CFO On-call makes financial sense. We have a proven track record of creating a 5 to 10 times return on investment. By leveraging the expertise of our virtual CFOs, your business can benefit significantly in several essential ways, including:

In the dynamic landscape of Small and Medium-sized Enterprises (SMEs), the pursuit of profit maximization is a constant...

Read StoryGet the financial information you need to shed light on your financial blind spots, improve your efficiency, and bolster your cashflow. Click below to order your book.

Order My Copy