Hiring a Financial Controller or CFO is the key to avoiding self-managed finance

When your business is in financial growth mode, there’s only one thing worth more than the money you’re bringing in: the steadfast business advice you need to manage it well.

For this reason, many businesses choose to hire both a Financial Controller and a CFO to assist, but even the most diligent business owner could be forgiven for misunderstanding the differences between the two.

According to Sue Hirst, Co-founder of CFO On Call, the strategic guidance you can expect from a Financial Controller or CFO is critical to making well-informed, future-oriented business decisions:

“While an accountant may be able to provide necessary guidance on how to navigate things like legislation and payroll, what they lack – and what is arguably the most important asset for any business right now – is strong commercial acumen.”

It’s no secret that effective financial guidance is essential for any well-functioning business, but how do you know who to turn to for advice? Do you need a Financial Controller, a CFO, or both?

Read on to find out what both Financial Controllers and CFOs actually do, how they differ, and how your business could benefit from each.

Topics of discussion:

- What does a Financial Controller do?

- What are the benefits of hiring a Financial Controller?

- What does a CFO do?

- What are the benefits of hiring a CFO?

- What is the relationship between CFO and Financial Controller?

- Do you need both a CFO and a Financial Controller in your business?

- When should I hire a CFO?

- What should I be looking for when hiring a CFO?

What does a Financial Controller do?

Financial Controllers take responsibility for various reporting, analysis, and management tasks within your business. The most important aspect of their role is to ensure the integrity of accounting functions, create and analyse financial reports, and advise the CEO or business owner accordingly. A Financial Controller can also assist with matters such as systematising and managing your financial processes, and mentoring your financial team of bookkeeping, accounts receivable and accounts payable staff members.

What are the benefits of hiring a Financial Controller?

Hiring a Financial Controller could be beneficial for your business if you have an ongoing need for accurate and timely advice relating to compliance matters and the general financial position of your business. The role of a Financial Controller focuses on increasing business owner confidence through compliance-oriented tasks, ensuring that the business complies with internal and external financial requirements.

What does a CFO do?

A CFO is responsible for tending to a range of high-level matters in your business. They work with you as the owner or CEO to determine the viability of your business, create an accurate budget that reflects your plans for growth, and liaise with various internal and external stakeholders, including lenders and investors, to ensure that your business achieves these goals. If and when you decide to exit your business, your CFO will also assist you with creating and executing these plans for maximum financial benefit.

According to Sue Hirst, specific activities a CFO manages include monitoring financial statements, managing liquidity, analysing financial reports, and forecasting future cash flows within the organisation. “A chief financial officer (CFO) is an executive officer responsible for creating and implementing financial strategies that manage the past, present, and future financial situations and actions of an organisation.”

A CFO or Financial Officer can bring extensive knowledge and experience to your team meetings (Source: https://www.pexels.com/photo/man-wearing-white-long-sleeved-shirt-holding-black-pen-3182781/)

What are the benefits of hiring a CFO?

Business owners will notice many immediate benefits to hiring a CFO. An adept CFO will not only deepen your understanding of and confidence in your business operations and future plans, but also act as a sounding board for any problems and ideas that arise. They can assist with creating plans for financial results, communicate with lenders and investors on your behalf, and deliver a big-picture financial focus that drives business growth.

Do you need both a Financial Controller and a CFO in your business?

If your business and revenue is large enough, you may benefit from hiring both a Financial controller and a CFO, either on a full-time or contract basis. However, if you are operating as a small to medium enterprise, you may only need periodic access to high-level guidance to complement the direction you receive from an accountant or bookkeeper. For these situations, you have the option of hiring an outsourced CFO or Financial Controller for a day rate.

When should I hire a CFO?

Hiring a CFO is an important growth step for large corporations managing high-growth business opportunities. As a rule of thumb, you should only consider hiring a full time CFO once your company is generating annual revenue of $50 million or more. With the right systems in place, a good CFO can manage both the high-level strategy roles and the hands-on financial management aspect of your business. If your business is smaller, you can still have the benefits of a CFO on a part-time or outsourced basis for a reasonable fee.

What should I look for when hiring a CFO?

As a key leadership position in any business, CFOs require extensive industry knowledge and passion and highly developed skills in leadership, communication, and problem-solving. They should also have at least ten years of experience in a senior leadership role and qualifications in a business or financial discipline.

What does a CFO cost?

Most CFOs earn an annual salary of between $160,000 to $220,000. As of September 2021, the average salary for an Australian CFO is $159,071, although this average varies widely by location, with a top salary of $187,701 in Perth. However, if your company does not require a full-time in-house CFO, you have the option of hiring a remote CFO to cut costs. The typical day rate for an outsourced CFO on-call is approximately $1500.

When should I hire a Financial Controller?

Rapid expansion in your business is the biggest indication that you may need to hire an in-house Financial Controller, particularly if your company is generating between $1 million and $10 million in annual revenue. A Financial Controller is also a great support for your business if your existing financial management positions, including your accountant or CEO, are struggling with an overwhelming workload.

What should I look for when hiring a Financial Controller?

The position of Financial Controller requires a specialised financial knowledge base and breadth of experience. A management or financial accounting background is a strong foundation, as the role requires strong accounting and numeracy skills. In terms of soft skills, business owners should prioritise potential hires who are proficient in leading and managing teams with a proven ability to meet and manage deadlines.

How much do Financial Controllers get paid?

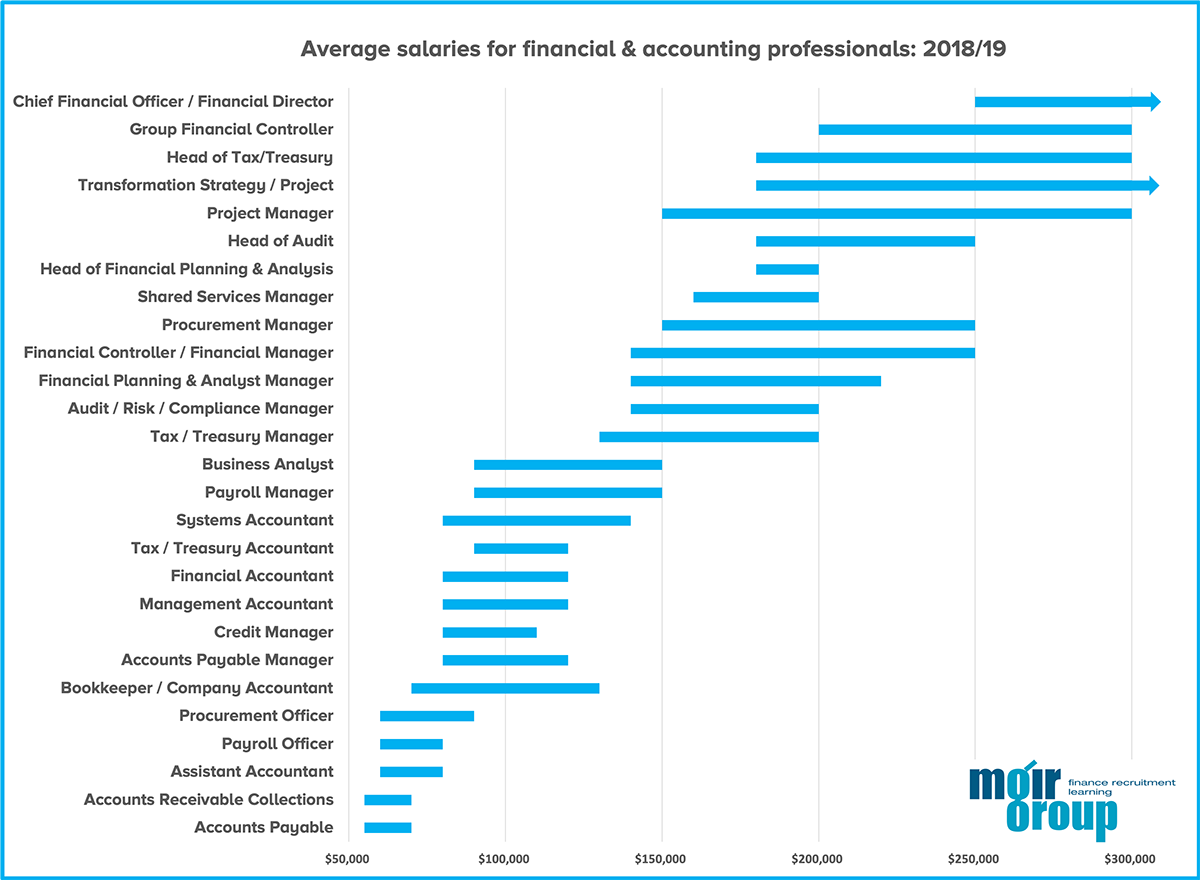

Salaries for Australian financial controllers range from approximately $130,000 for entry-level employees to more than $180,000 for the most experienced workers, with an average of $155,000 per year. According to a 2018/2019 salary review, the hourly rate for this role varies from $110 to $180.

A public salary review from Moir Group (Source: https://moirgroup.com.au/2018/12/finance-accounting-salary-review-2018-19/)

If you’d like to read more about how CFOs help businesses to achieve better results, download our eBook ‘Virtual CFOs – A Rising Trend in 2021 and beyond’